Fintech meets crypto #10

Stripe gets into in-car payments, Bitcoin beats Amex and a bunch of payments predictions

Hi friends 👋

Welcome to “Fintech 🤝 crypto” - episode #10!

Number 10! Small anniversary it is! 🤩

Time flies and the fintech x crypto space is not slowing down. January 2022 was pretty damn hard for crypto space. Fintech got some serious hits too - at least public fintech companies: PayPal -25%, Block (Square) -10%, Sofi Technologies (-20%).

But if you zoom out, you can see this:

The Matrix Fintech Index is a market-cap weighted index that tracks a portfolio of 25 leading public fintech companies.

As you can see, Fintech continued to outperform the market by 3x.

You can see January 2022 as a difficult month both for crypto and fintech but don’t do it. The fundamentals are the same, nothing changed. Funding is strong. Crypto adoption rates are increasing. We are still early.

Let’s go! 🚀

If you want to get new episodes directly into your mailbox, hit the button below:

Happened recently 👀

1) Affirm wants to become a super-app with crypto offering 🤔

In short:

Affirm, known for its “buy now, pay later” options, beefed up its app as the firm works toward a crypto offering. The company’s new app puts all of its offerings together in one place making it a “super app”.

My comment:

It seems like the biggest fintech companies have only three paths to evolve:

Become a bank.

Become a super app.

Be acquired (or die).

Affirm chose the second option. They started in the BNPL sector but recently they have revamped their mobile app as a part of the “architectural decision” that will help the company innovate even faster.

They want to enter the crypto market as well. Nothing surprising here. As I’ve mentioned several times, we will see more and more news about fintech companies flirting with the crypto / DeFi universe.

2) Ford-Stripe partnership aims to transform cars into tokenized wallets 🚘

In short:

Ford & Stripe established a five-year partnership, where Stripe will be a payment service provider for Ford and its dealers in Europe and North America, cars will ultimately function as tokenized wallets.

My comment:

If you are “Fintech meets crypto” reader, you shouldn’t be surprised by this news. I’ve covered the in-car payments already (e.g. in Fintech meets crypto #4, Nov 2021) - this is a huge and under-served market. As of now.

Smart move from Stripe. They are probably talking with other global car manufacturers to offer them similar services.

3) Summary of Apple’s payments business enhancements in 2021 🍏

In short:

Apple released an overview of updates to its payments business and other service upgrades in 2021.

Apple is pushing really hard to encourage more iPhone users to adopt Apple Pay.

My comment:

In 2022 & 2023 we will see a lot of innovative features that can make APple’s payment solution more compelling.

Besides enabling Wallet support for state IDs and driver’s licenses (in the USA):

Apple is reportedly considering a buy now, pay later (BNPL) program that would be tied to the Apple Wallet.

There were also rumors Apple was weighing a cryptocurrency payments integration.

4) Gibraltar Could Launch the World’s First Crypto Stock Exchange 📈 📉

In short:

Gibraltar wants to launch the world’s first crypto stock exchange.

“The Rock” hopes a new stock exchange will attract crypto millionaires who want to avoid hefty taxes.

My comment:

This news fits into Gibraltar’s new strategy: over the past few years Gibraltar has been working to restyle itself as a global cryptocurrency and blockchain hub, approving a regulatory framework for crypto businesses that want to be based in the territory.

So far, 15 companies, including crypto exchanges Huobi and Bullish, have established their HQs in Gibraltar. Binance - the world’s largest crypto exchange - is also pondering a move to Gibraltar.

5) Facebook’s cryptocurrency Diem is officially dead ☠️

In short:

The Diem Association, a consortium of companies working on a blockchain-based payment system, is selling its technology assets to Silvergate Capital for $200 million.

The announcement caps a nearly three-year odyssey on the part of Facebook and its partners to launch a digital currency, which was first dubbed Libra in 2019 until its rebranding as Diem in 2020

Diem represented Facebook’s most ambitious bet on cryptocurrencies.

My comment:

From the very beginning, the lawmakers and regulators (both in the USA and Europe) derailed Diem's ambitions, stoked by fears around how such an offering on the scale of Facebook would impact the financial system and the control central banks assert over money.

As a result, Diem - a stablecoin (type of cryptocurrency tied to other kinds of assets) - never launched.

It was a dead project from early on. And now Facebook (aka Meta) finally got rid of it.

6) Crypto credit card usage reaches $2.5 Billion in Q1: Visa

In short:

Visa said during its recent earnings call that customers made $2.5 billion in payments with its crypto-linked cards in its fiscal first quarter of 2022 (Visa defines the quarter ending December 31 as its first quarter of the new year).

That was 70% of the company’s crypto volume for all of fiscal 2021 🤯

My comment:

Despite volatility in the cryptocurrency markets, the adoption of crypto as a means of payment appears to be rising.

The crypto-linked cards are an interesting product for Visa: they allow customers to spend crypto anywhere that accepts Visa, without merchants having to be familiar with the asset class at all. Merchants receive transactions in fiat like typical Visa transactions, while the payment processor handles conversions on the back end.

The crypto adoption rate is increasing and it won’t stop in the upcoming years, that’s for sure.

7) Bitcoin Surpasses Amex in Annual Transaction Volume

In short:

Bitcoin has jumped ahead of American Express in annual payment transaction volume.

In 2021, Bitcoin processed $3.0T worth of payments, placing it above well-known card networks American Express ($1.3T) and Discover ($0.5T), but still below Visa ($13.5T) and Mastercard ($7.7T):

My comment:

There are two more great charts in the linked article. They are showing the dynamic growth of Bitcoin in the payments ecosystem.

Just look at these numbers:

Great reads worth your time 📚

📕 Payment predictions for an industry in flux (Alex Rolfe)

If you are a fintech geek and interested in payments, this piece will give you a nice overview of the potential future of the payment ecosystem.

There are 5 main predictions (crypto, BNPL, travel industry, regulators, M&A) - all well described.

📘 5 of the Biggest Bitcoin Crashes—And How This One Compares (Jeff Benson)

January 2022 was hard for Bitcoin (-23 percent since the start of the year) and other cryptocurrencies. It wasn’t the first crash. Or the last one.

This article describes the 5 biggest BTC crashes in history and what caused them.

If you want to be prepared for the future, you should know the past, right?

📗 The problem with Google Pay (Ron Shelvin)

Google doesn’t know what Google Pay is and what it should be.

As Bob Dylan once sang, “you’re gonna have to serve somebody,” and Google Pay’s problem is it doesn’t know who it’s serving.

Ron Shelvin wrote an excellent piece about why the problem(s) with Google Pay. He describes the story behind the product and what it is still missing.

📙 The Coming Crisis in the Decentralized Lending Market (Julia Magas)

Lending has become the fastest-growing sector of decentralized finance (DeFi) in recent years:

However, some experts are foreseeing potential problems on the horizon.

Definitely worth reading if you are into DeFi and want to expand your knowledge of the sector. Julia is making some really good points (e.g. the need for DeFi bonds).

Gold Tweets 🏅

1. A thread explaining why company’s valuation does not matter on its own. And why “net take rate” is an important metric:

2. Last year was pretty crazy for fintech companies and funding.

“14 fintech deals were announced every day, worth $387,777,777 every 24 hours”

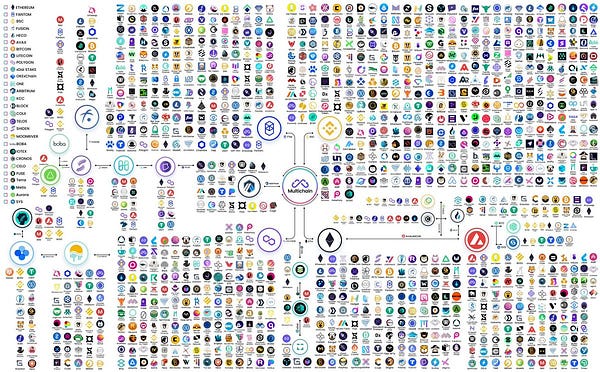

3. All chains on one picture:

4. And two more:

That’s all for now 👋

Remember, if you're enjoying this content, please do tell all your fintech and crypto friends to check it out and hit the subscribe button.

And feel free to reach out to me on Twitter or Linkedin.

Stay curious,

/Pawel