Fintech meets crypto #1

Intro to DeFi, Spanish Banks are crypto-ready & Fintech 3.0 is coming

Hi 👋

This is the first episode of our common journey into the DeFi world. But before we arrive there you need to know that this path is not easy.

Especially if you are coming from the traditional finance (TradFi) or fintech space - the number of new words, weird acronyms, not-so-straightforward concepts & protocols can be overwhelming. And, on top of that, there are new products launched every single week. 🤯

Yes, this all might be discouraging and intimidating but not for you.

You are in good hands.

Welcome to “Fintech 🤝 crypto” - episode #1 (reading time: 6 mins).

Let’s go! 🚀

Weekly theme - DeFi 🤔

I cannot imagine starting this newsletter without explaining to you, at the very beginning, what Decentralized Finance (DeFi) is.

// Disclaimer — Since one of my goals for this newsletter is to write short posts (reading time < 10 mins) using simple vocabulary to build uncomplicated and clean explanations (kind of “explain-me-like-I’m-five” attitude), I will often simplify things here but at the same time I will recommend more in-depth explanations by linking some great articles about the given topic. //

What is DeFi? 🎯

What would be the simplest definition of decentralized finance, or DeFi? That’s easy. You may say that this is the ecosystem of financial applications being built on top of blockchain technology.

It doesn’t matter if these apps are using Ethereum, Solana, or Polygon, as an underlying blockchain. The thing is - they need to use blockchain as their backbone, otherwise, they could not be called “decentralized”.

How long is DeFi a thing? ⌛️

Well, you may say that it is a relatively young term because it was created in August 2018, so only 3 years ago. On the other hand, three years in the crypto space is a long time, DeFi had already its “DeFi summer” (last year, 2020), some bearish months, and now, in 2021, it is steadily getting into the mainstream.

DeFi vs TradFi 🤺

Many people claim that DeFI will disrupt the traditional banking systems (which is called TradFi, traditional finance, or CeFi - centralised finance, both terms mean the same). TradFi are your standard retail, commercial, and investment banks, along with fintech companies, such as Square, Monzo, or Chime.

DeFi examples please 🙏

Okay, so we know what DeFi means, we know that it’s the opposite of TradFi, but at this point, you probably think: “That’s all great Pawel, but please give some real-world examples of these DeFi apps!” and that would be a reasonable request.

The list could be very long so I will limit myself to name just 10 top DeFi apps so you know what to read about until the new “Fintech 🤝 crypto” appears in your mailbox.

Here is the list of the top 10 DeFi apps in 2021:

Protip: If you want to have a great start in the DeFI world, I would recommend going to each of these websites and reading about these apps. You can also start here.

Top 3 DeFI apps by Total Locked Value (TLV)1:

Other good reads about decentralized finance:

What is decentralized finance by Camila Russo - a deep dive into the DeFi ecosystem.

The Future of Crypto Banking by Tyler D. Warner - a really interesting article where the author tries to predict the possible future of DeFI in the TradFi world.

Happened last week 👀

$ETH surpassed the largest bank in the world (in market cap) 💸

In short: $ETH has passed the largest bank in the world, JP Morgan, in market cap.

My comment: $ETH indeed surpassed JP Morgan in market cap but minimally and it lasted for less than 24h. By many (including myself) this situation could be (and should be) seen as a bullish signal for Ethereum and clear proof that the Ethereum DeFI ecosystem is becoming bigger every month.

If you are interested in assets and their market capitalization, the best website for this is Companies by Market Cap.

Top 10 assets by market cap (source)

DeFi tops $100 billion for the first time ever 📈

In short: Bitcoin’s record rally helped push the value of assets used in decentralized finance to $100 billion for the first time, according to data compiled by DeFi Pulse.

My comment: Another milestone achieved this week. Total Value Locked (USD) in DeFi surpassed $100B. And to put this number in perspective below is the chart of TLV for the last 12 months. In Nov 2020 the TLV was at the level of $20B which means the growth is 5x in a year.

Spanish banks are preparing to offer crypto services 🇪🇸

In short: Banks in Spain are getting ready to offer crypto services to their clients, but are being frustrated by the lack of clarity from their central bank.

My comment: This news is interesting because it seems that Spanish banks are interested in general in crypto services. Not only in a single cryptocurrency, like bitcoin (see: El Salvador). I expect more of this kind of news coming from different countries in the next 6-12 months.

Worldcoin wants to scan every human’s eyeball in exchange for crypto 👁

In short: The startup, founded by OpenAI CEO Sam Altman and Alex Blania, wants to put a crypto wallet (and some of their currency) onto every human’s smartphone, but in order to do so they have to build a way to determine whether someone is a unique human. To do so, they need to scan a billion people’s eyeballs with a five-pound chromatic sphere called “The Orb”. Blania says that on average contractors have been able to onboard over 700 users per Orb per week in early testing across four continents: South America, Asia, Africa, and Europe.

My comment: This is so twisted. First - the name. Worldcoin. Can’t imagine the worst name. Then the idea. Scanning the eyeballs in exchange for crypto. They started with underdeveloped countries where they see some traction but I expect a total failure in more developed regions (like the US or West Europe). Nobody will let them scan their eyeball in exchange for the Worldcoin token. Why would anybody do that?

The Bank of Israel aims to launch its CBDC on Ethereum 🏦

In short: The Bank of Israel wants to build their CBDC (Central Bank Digital Currency) using Ethereum blockchain. They have just launched the pilot programme.

My comment: The Bank of Israel wants to use Ethereum but it’s a private Ethereum network, not the mainnet. That means that this news is less groundbreaking than one could expect. On the other hand, it is still worth noting since CDBCs are being developed by many countries but none of them is using publicly available blockchains. Let’s see how it develops in the next months.

Great reads worth your time 📚

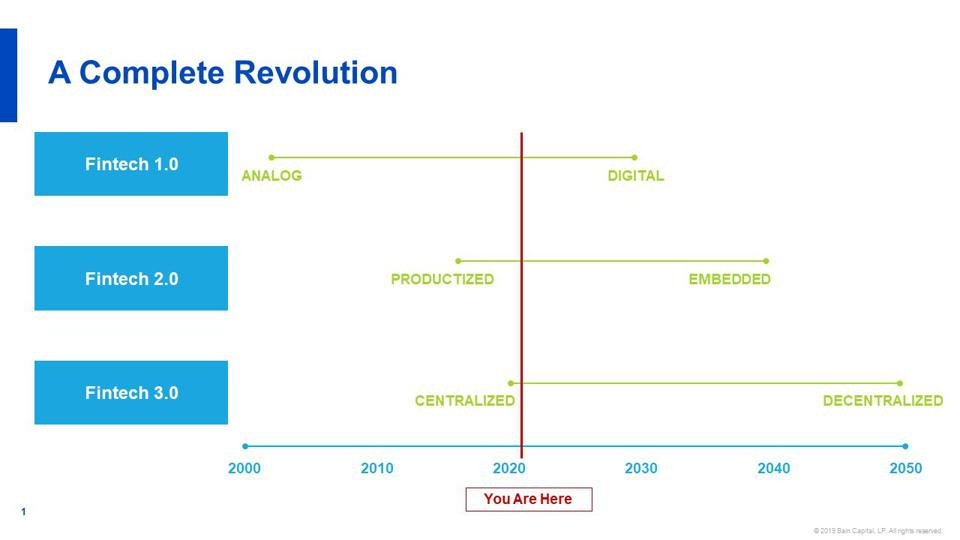

1. The Future Of Money: A Complete Revolution (by Matthew Harris)

If you are into fintech & crypto, this is a must-read for you. The main thesis of this article is:

Over the next 30 years, financial services will go from centralized to decentralized, completing the revolution.

The author sees the (r)evolution of financial services happening in three stages:

Going from analog to digital - fintech 1.0

Going from productized to embedded - fintech 2.0

Going from centralized to decentralized - fintech 3.0

If the future of money is digital, embedded, and decentralized, there are some serious problems that need to be solved.

I highly recommend reading this bit by Matthew Harris - it gives you a big picture of the future of finance in a very clean and elegant way.

Gold Tweets 🏅

Are we in the fintech bubble or not? 💸 Here is a great thread by Nicole Casperson around this question:

The best and simplest explanation of NFT. Exceptional thread - not only for the newcomers but also for people who are already in crypto but still don't get the idea behind NFTs:

FinTech valuations are on 🔥 FTX & Brex have joined the elite group of fintech decacorns (who cares about unicorns, inflation is a real thing):

And two more tweets that are just

🎯

That’s all for now 👋

Next episode - next Sunday. Have a great week everyone!

Remember, if you're enjoying this content, please do tell all your fintech and crypto friends to check it out and hit the subscribe button!

Feel free to follow me / DM me on twitter!

/P.

Full list available here: https://defipulse.com