Fintech 🤝 crypto #2

DeFi 2.0 is here, Mastercard joins the crypto game & stablecoins deserve regulations

Hi 👋

Time flies, right? So many things happened last week! Welcome to the second episode of “Fintech meets crypto” (reading time: 7 mins).

If you want to get new episodes directly into your mailbox, hit the button below:

Alright, let’s go! 🚀

Weekly theme - DeFi 2.0 🤔

Last week I wrote a short introduction to DeFi - Decentralized Finance. What it is, what protocols are the most important ones and how it differs from the traditional finance ecosystem.

This week I would like to introduce you to… DeFi 2.0. You probably ask: wait, what? Standard DeFi seems to be still in the dynamic development phase and now you are talking about version 2.0? What the heck?

Over the past few weeks, you may have begun to see the term “DeFi 2.0” appear on crypto twitter.

But what is DeFi 2.0?

How does it differ from the “classic” DeFi?

The simplest explanation would be:

DeFi 2.0 is a general term for the second-generation of DeFI protocols. If we think of Compound and Maker as the original blend DeFi, this next wave of projects is the macchiato. Though there are ingredients that are familiar, there are also some others that are supposed to be totally new.

Some examples of DeFi 2.0 protocols are:

OlympusDAO (huge hype here! 🔥)

It’s not easy to grasp the idea of DeFi 2.0 movement. One good explanation is this one, by Rhys Lindmark:

One frame that I found helpful is that it's GenZ kids (Crypto Class 2018) who grew up on liquidity farming and DAOs, and are now iterating on those mechanisms.

When DeFi 1.0 was being developed, there wasn't much before it. MakerDAO CDPs were an innovative thing. But now they're just the water the GenZ kids swim in. Table stakes.

The basic, old good DeFi 1.0 protocols were created 4-5 years ago. Now a new wave of protocols entered the market and they can be seen as a second iteration.

I strongly encourage you to go and read an amazing piece by Rhys Lindmark:

if you want to know more about DeFi 2.0 movement, what is going on in the space right now, how it started and what the future might bring.

And if you are more into the youtube content, here is a short video about DeFi 2.0:

Happened last week 👀

1) Mastercard wants to offer crypto services to any bank or merchant 🌎

In short:

Soon merchants & banks within Mastercard’s payments network will be able to accept crypto and offer crypto rewards.

To do so, the payments network is partnering with Bakkt which will be the behind-the-scenes provider of custodial services.

My comment: Big news. Seems that Mastercard finally joined the game. VISA has been active in NFT & crypto space for some time now. It was pretty weird seeing Mastercard that inactive compared to its main competitor. More details should be known in the next couple of weeks.

2) Facebook goes big with Metaverse 💥

In short: Facebook will invest billions of dollars to build their “metaverse” ecosystem in the next years. Plus they have changed the name to… Meta 🤷♂️

My comment: Mark really wants to be remembered as “Mark-the-builder”, doesn’t he. And now he wants to build the metaverse. First the announcement of pouring gazillion dollars into the augmented reality projects. Three days later - changing the name to “Meta”. I expect them to fail miserably. And this is why:

3) Crypto body lobbies the US on stablecoin push 🏦

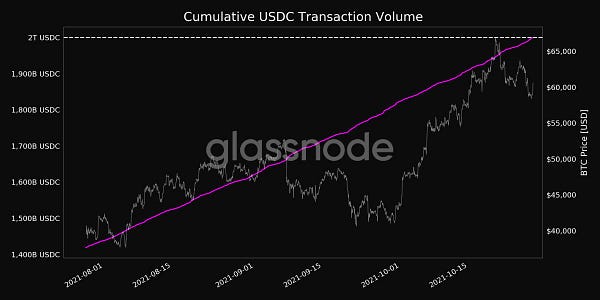

In short: The US lobbying group published a letter to the top US officials where they argue that stablecoins should not be regulated as securities or money market funds. Meanwhile, USDC (one of the stablecoins) has done $2 trillion in on-chain transactions:

My comment: I encourage you to go and read this letter. These guys make really solid points. They state that:

“Stablecoins, a type of digital payments instrument, bridge the gap between the innovations of digital tokens and the functionality of legacy payment systems.”

and this is true.

The American payment system is old and archaic. Financial infrastructure is outdated. If they can regulate stablecoins in a proper way, they can win a lot.

4) Klarna & Stripe join forces in the ‘Buy Now, Pay Later” battle 🤝

In short: Online payments processor Stripe has entered a strategic partnership with “buy now, pay later” company Klarna, allowing retailers easily to add an option for customers to pay in installments.

My comment: The battle to dominate the BNPL market is still ongoing. Almost every week there is news about another merger, partnership, or acquisition in this space. This week brought us huge news. Klarna & Stripe are well-established fintech players. This partnership will help both companies to get a bigger chunk of the BNPL market. Smart move.

Great reads worth your time 📚

1. Why Wallets Excite Me Again (by Richard Burton)

Really good article about the state of crypto wallets. How it all started and where are we now. The progress is clearly visible but there is still much to be improved.

2. Invisible Hierarchies (by Dror Poleg)

Interesting piece about how DAOs (Decentralized Autonomous Organizations) can be seen as a new type of employment that may disrupt the existing status quo (traditional corporations fighting for talented employees).

3. The case for digital assets (by Eric Peters)

Money is an illusion, perhaps the world’s greatest mass delusion. Out of desire and necessity, we succumb to the hypnosis. Without money, we are lost. And while we cling to its supposed permanence, a quick survey of history tells us money is anything but.

A must-read essay for those who still claim that digital assets are worthless.

Gold Tweets 🏅

If you ever wondered what it takes to build a challenger bank from scratch:

Solid thread about main use cases for NFTs:

If you still think that you are late to the party:

And three more great tweets 💯

That’s all for now 👋

Next episode - next Sunday. Have a great week everyone!

Remember, if you're enjoying this content, please do tell all your fintech and crypto friends to check it out and hit the subscribe button!

Feel free to follow me on twitter (or send me a DM).

Cheers,

/Paweł