Fintech meets crypto #13

State of Crypto Report, Stripe loves BTC again and why Time-To-Money matters so much.

Hi 👋

Time flies. We are almost halfway through 2022. The bear market is real and will probably stay with us for the rest of the year (if not longer). However, regardless if it’s a bull or bear market, there is still so much happening in the fintech x crypto space.

Only good stuff below. And since this one is a bit longer (lucky number 13!), I won’t bore you with a lengthy introduction.

(Sometimes email clients clip the bottom of the content. If you don’t want to miss anything, click here for the website version).

Welcome to “Fintech meets crypto” - episode #13.

Let’s go! 🚀

If you want to get new episodes directly into your mailbox, hit the button below:

Weekly theme 🤔

Recently a16z crypto team published their first annual 2022 State of Crypto Report. It’s a great read (full version available here) that shows how far crypto has come and how early we still are.

Some of you will probably read the whole report but others might be interested only in the highlights.

I’ve compiled the key takeaways from the report and created a short list👇

#1 - We’re in the middle of the fourth ‘price-innovation’ cycle

According to the a16z crypto team:

Whereas prices are often a lagging indicator of performance in some industries, in crypto they are a leading indicator. Prices are a hook. The numbers drive interest, which drives ideas and activity, which in turn drives innovation. We call this feedback loop “the price-innovation cycle”.

So in short it goes like this:

Prices invite interest → driving new ideas → leading to new projects and experiments → creating new protocols and assets.

#2 - Crypto is already having a real-world impact

For underserved and unbanked populations, crypto offers new paths to financial inclusion. And it’s much more than just a financial innovation – it’s a social, cultural, and technological.

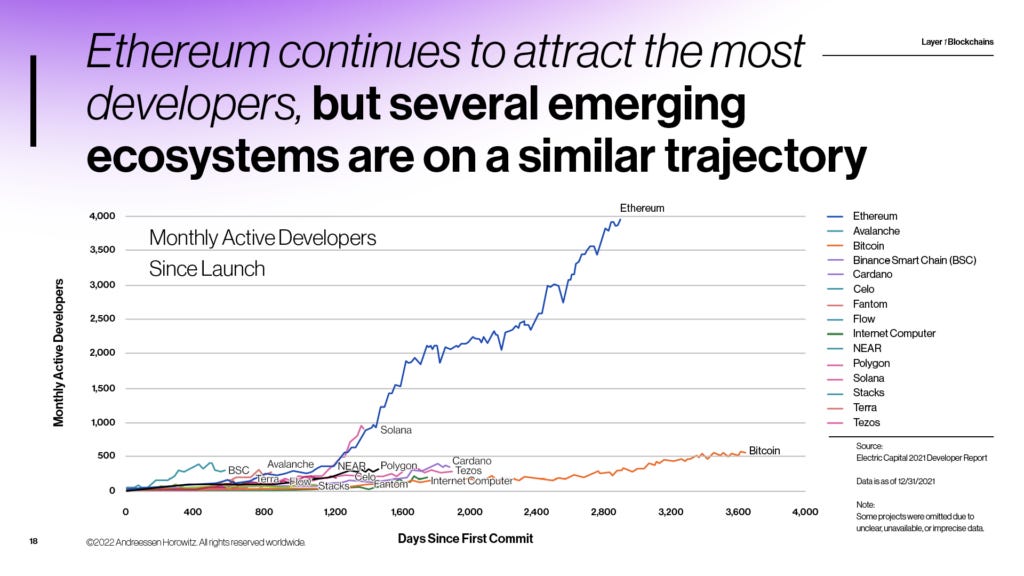

#3 - Ethereum is the clear leader, but faces competition

Other layer 1 blockchains have grown rapidly over the last year, but Ethereum is the clear leader. Ethereum’s lead has much to do with its early start, and, the health of its community. As far as developer interest, Ethereum has far and away the most builders, with nearly 4,000 monthly active developers.

Happened recently 👀

1) European Union Plans Pilot Project on DeFi Supervision 🇪🇺

In short:

European Commission intends to be at the forefront of the rules that could shape a decentralized financial world.

In a recent report, the EU’s executive arm revealed it will test an embedded form of DeFi’s supervision, which is now mainly unregulated, through a pilot.

My comment:

Good news! If we want to have DeFi (crypto in general) getting more and more users, we need more regulations.

EU is already working on stablecoin regulations (MiCA document) and now we are hearing that DeFi might also get a proper regulation in the EU. And this is just great.

2) JPMorgan’s blockchain Onyx will be used by French giant - BNP Paribas 🏦

In short:

French banking giant BNP Paribas, the second-largest banking group in Europe, is now trading digital tokens on JPMorgan’s blockchain network for short-term asset loans.

This makes BNP Paribas the first European bank to trade on the blockchain-based network.

JPMorgan’s permissioned blockchain Onyx tokenizes US Treasurys for fast settlement within intraday repo markets.

My comment:

Next time you hear from a blockchain skeptic that “but there is no real use-case for blockchain!” just tell them this news. JP Morgan + BNP Paribas.

It’s a perfect example of an old-school (but huge) TradFi banking group using blockchain technology for trading assets. The transactions are done, settled, and matured within a day.

3) Stripe let customers convert funds into Bitcoin - again 🤔

In short:

Stripe has announced that customers will once again be able to convert incoming payments or any balances into Bitcoin - four years after suspending the service.

My comment:

Why does Stripe, after 4 years, love Bitcoin again?

It’s all because of the Lighting Network technology. Lighting Network is a Bitcoin Layer 2 scaling solution that processes transactions off-chain, making operations on the main (layer 1) blockchain faster and cheaper.

Here is a good beginner’s guide to the Lighting Network if you are interested in digging deeper.

4) Google Chrome is getting built-in virtual credit cards 💳

In short:

Google announced that its Chrome browser will now offer users the ability to use a virtual credit card number in online payment forms on the web.

My comment:

Super smart move by Google. The user experience will be exactly the same as using Chrome Autofill to enter in your credit card details but with an added layer of security. Instead of using your real card number and security code, the one-time virtual ones will be used.

In other words: instead of tokenizing cards on the issuer level, they are “tokenized” (or “virtualized”) in the browser.

💥 Quick takes 💥

🇩🇪 Germany’s crypto ecosystem has finally nationwide tax guidance (success!)

📉 Fintech startups are in serious trouble - bloodbath is coming?

Great reads worth your time 📚

📕 Time-to-Money as a competitive advantage

Fascinating essay about "time-to-money” and why it matters so much. Why incumbents are bad at it and why fintechs (like Stripe or Square) are laser-focused on increasing time-to-money value proposition.

Loosely defined, time-to-money represents the amount of time between when value is attributable to you (the clock can start either when someone starts to owe you money or when they’ve initiated the payment, just depends on the scenario), and when its available to you to use.

📗 Crypto, Clearing, and Credit (by Matt Levine, Bloomberg)

Excellent (!) summary from Matt Levine of crypto financial systems vs. traditional financial markets (the first part of the article)

📘 'Buy now, pay later' is sending the TikTok generation spiraling into debt (by Joshua Bote, SFGATE)

‘Buy now, pay later’ is taking Generation Z (that uses TikTok) by storm:

In California alone, 91% of all consumer loans in 2020, were buy now, pay later loans, also known as point-of-sale loans.

Gen Z, in particular, has fallen in love with the short-term loans, spending 925% more now through point-of-sale services than in January 2020.

Good article about the negative impact BNPL has on the TikTok generation and concerns about how companies target these consumers.

Gold Tweets 🏅

1. What we learned from Terra/Luna fallout - a thread:

2. In 2021, at its peak, crypto was worth almost $3T (in June 2022 - a little over $1T…). How much is $3T compared to other assets? A thread:

3. “Bitcoin uses dirty, coal-based energy - it should be banned!” is a commonly used argument by people that are against crypto. But is that really true in 2022?

4. And two more tweets:

* I assume that this graph 👆 is from the book “Crossing the Chasm” by Geoffrey A. Moore. Rumour has it that it’s worth reading (and it is on my to-read list on Goodreads).

That’s all for now 👋

Remember, if you're enjoying this content, please do tell all your fintech and crypto friends to check it out and hit the subscribe button.

And feel free to reach out to me on Twitter or Linkedin.

Stay curious,

/Pawel