Fintech meets crypto #6

DeFi space overview in 7 graphs, BNPL strikes back and why consumer fintech is still a greenfield

Hi 👋

This week - fewer words, more visuals.

DeFi space can be overwhelming, especially if you are a newcomer (from TradFi).

That is why in the first part of this edition (weekly theme) I present 7 interesting graphs that can help you understand where we are, what the main components of DeFi ecosystem are and what the future might bring.

Welcome to “Fintech 🤝 crypto” - episode #6

If you want to get new episodes directly into your mailbox, hit the button below:

Let’s go! 🚀

Weekly theme - DeFi visual overview 🤔

by Bitwise Investments

“A picture is worth a thousand words” which is why this week’s weekly theme will be mostly visual 👀

The source of all graphs & tables below is a really interesting report created by Bitwise Investments:

I highly recommend reading the whole report (it’s not that long, 16 pages) but if you don’t have time (and we are all so busy, aren’t we), I’m here to help you.

In the list below you will find some charts & graphics from this primer that I’ve found interesting 🧐 They nicely summarize the current1 state of DeFi space.

Off we go! 💥

👉 TradFi vs Fintech vs DeFi in one picture:

Maybe a bit oversimplified but I still like it.

“Decentralized Finance rewires the back end of the traditional finance while offering fintech-like front ends” 💯

👉 Total Value Locked (TVL) in all DeFi apps & protocols in time:

Take a close look at the timeline. Over $200B in just one and a half year! 🤯 +$50B in the last 6 months. As of today (Dec 1st, 2021) it’s over $280 billion.

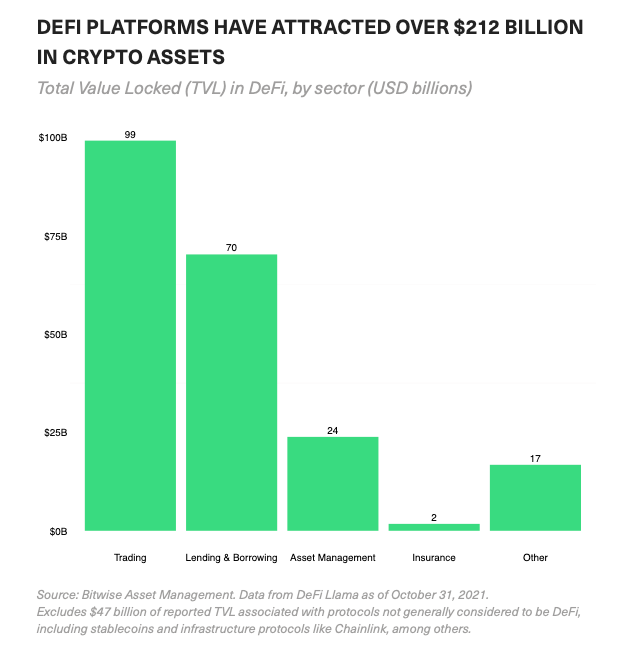

👉 Total Value Locked in DeFi by sector:

No surprises here. Right now Trading, Lending & Borrowing are the leading forces behind DeFi. However, new sectors are emerging - like Asset Management or Insurance. We can expect new DeFi use cases in 2022, that’s for sure.

👉 Web 2.0 vs Web 3.0 stacks:

👉 Blockchains overview

DeFi apps are built on the top of blockchains and this table gives a nice overview of the 7 biggest (by market cap) chains.

A few things worth noting:

Cardano & Polkadot have exactly 0 DeFi apps.

Solana is soooo close to becoming number #2.

Avalanche - although it’s 6th - has over 50 DeFI apps working on it which is quite impressive. Some people believe that Avalanche will become number #2 or #3 in 2022.

There is only one DeFi king - Ethereum. 👑 At least in 2021.

👉 Top DeFi apps by market cap:

Top DeFi apps by market cap - I wrote about some of them in “Fintech meets crypto #1”.

👉 DeFI’s potential growth:

That’s an interesting chart. It tries to paint the DeFI market capitalization versus other disruptive technologies. As of now:

E-commerce achieved almost 71% of the market cap of traditional retail.

Tesla has grown to 67% of the size of all other traditional automakers.

Fintech companies have achieved 49% of the market ca of traditional payment companies (like Visa or Mastercard).

Bitcoin is with us for 10 years and it has grown to 10% of the size of the traditional gold market.

DeFi right now has less than 1% of TradFi’s market cap. The potential for growth is huge.

Happened last week 👀

1) Crypto start-up MoonPay hits $3.4 billion valuation 💰

In short:

MoonPay, a payment infrastructure provider for crypto companies, has raised $555 million in its first-ever financing round. The valuation? $3.4 billion 🤯

The funds will be used to hire people, expand geographic coverage and add more payment methods.

My comment:

MoonPay lets users buy cryptocurrencies using conventional payment methods like credit cards. The idea might seem pretty simple but the execution is what matters. And MoonPay does this one thing very well.

In order to get more people involved in DeFI, it needs to be super easy and convenient for them to exchange fiat currency for cryptocurrencies. UX needs to be great, fees as low as possible. And this is exactly where MoonPay shines. Apparently, investors see that and they foresee the great potential for this company that operates in this sweet spot between TradFi and DeFi.

The market opportunity for this type of company is huge so I expect more fintechs and new players will try to grab a piece of on-ramp cake in 2022 🍰

In short:

U.S. payments giant Square wants to build a decentralized platform called tbDEX for exchanging cryptocurrencies like Bitcoin as well as fiat currency and real-world goods.

My comment:

As I mentioned in my previous “Fintech meets crypto”, more and more fintechs will expand their portfolio with crypto-services and this is a great example of this trend.

This news is not a huge surprise. Square’s CEO - Jack Dorsey (who, btw, resigned last week from being CEO of Twitter) - is a big fan of Bitcoin. He even once said: “Whatever my companies can do to make it accessible to everyone is how I’m going to spend the rest of my life.”

3) Afterpay offers BNPL subscription for US customers 🤔

In short:

The buy now, pay later (BNPL) company Afterpay has unveiled a subscription solution, allowing customers to pay for recurring purchases in installments.

Afterpay will be offering this product to its U.S. customers so they can pay in installment for different subscriptions, like gym memberships, entertainment subscriptions, and online services.

My comment:

BNPL strikes back and it says hello to another (very hot 🔥) payment area - subscriptions.

I would expect that other big BNPL players (like Klarna, Affirm) will soon offer similar products.

5) Slope wants to become ‘Stripe for global B2B payments’ 🌎

In short:

Slope enables businesses an easy way to offer buy now, pay later services.

They are offering BNPL whitelabel product for merchants.

My comment:

The business proposition of Slope is simple. And compelling to many. If you want to offer BNPL to your customers, just use our API, integrate with us and you will have it. In a few days.

This is another BNPL news this week. If you think that BNPL market is saturated and there is no space for new fintechs there, you might want to rethink it.

The more merchants will offer BNPL at the checkout, the more customers will use it. And if the customer decides to pay in installments it means they do not pay with their debit or credit card (and VISA and MC want their piece of pie too!). BNPL is still a quite big opportunity for many fintechs. If they execute well.

Great reads worth your time 📚

📘 The Rise Of Many In Consumer Fintech (by a16z)

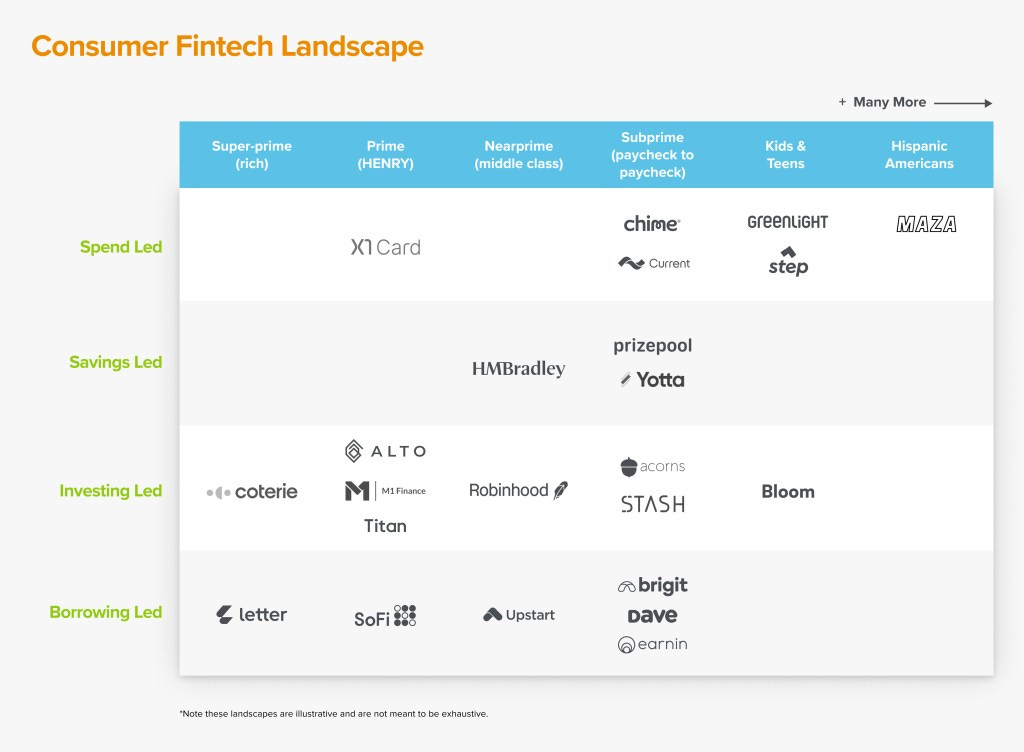

Banks typically only do four key functions for consumers — savings, spending, investing and lending. Most consumer fintechs lead with and innovate around one of these categories.

A lot of neobanks emerged in the last 5 years and they have a very similar offering. Why then are they all succeeding? The main reason is that they focus on different customer segments:

The authors predict that there is a huge market for consumer fintechs. And many niches are still not taken.

📕 Doomsday Scenarios in DeFi Revolve Around Stablecoins USDC and USDT (by Brady Dale)

If decentralized finance were a hero in a fable, its two fists were Uniswap and Curve (decentralized exchanges), Ethereum would be its heart and what about the legs? The hero would stand on two legs made of stablecoins - USDC and USDT - and this is the main premise of this article.

It’s a very interesting read for those who would like to fully understand why stablecoins are the key component of DeFi ecosystem. And why unforeseen regulations can shake up the current equilibrium state.

Gold Tweets 🏅

Nice comparison between web 1.0 vs 2.0 vs 3.0 in a single table:

Fintech vs crypto 🤔

Layer 2 solutions are getting some real traction. Total Value Locked (TLV) reached $7 billion (btw, l2beat.com is a great website to monitor L2 solutions on ETH):

Different points of view are always appreciated:

And two more tweets that are just 💯

That’s all for now 👋

Next episode - next week. Have a great one everyone!

Remember, if you're enjoying this content, please do tell all your fintech and crypto friends to check it out and hit the subscribe button.

Feel free to reach out to me:

Twitter: @pawt

LinkedIn: linkedin.com/in/paweltrybulski/

Stay hungry, stay foolish.

/Paweł

All data is from Oct 31, 2021.